40+ are mortgage points tax deductible 2021

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. Generally the IRS allows you to deduct the full amount of your points in the year you pay them.

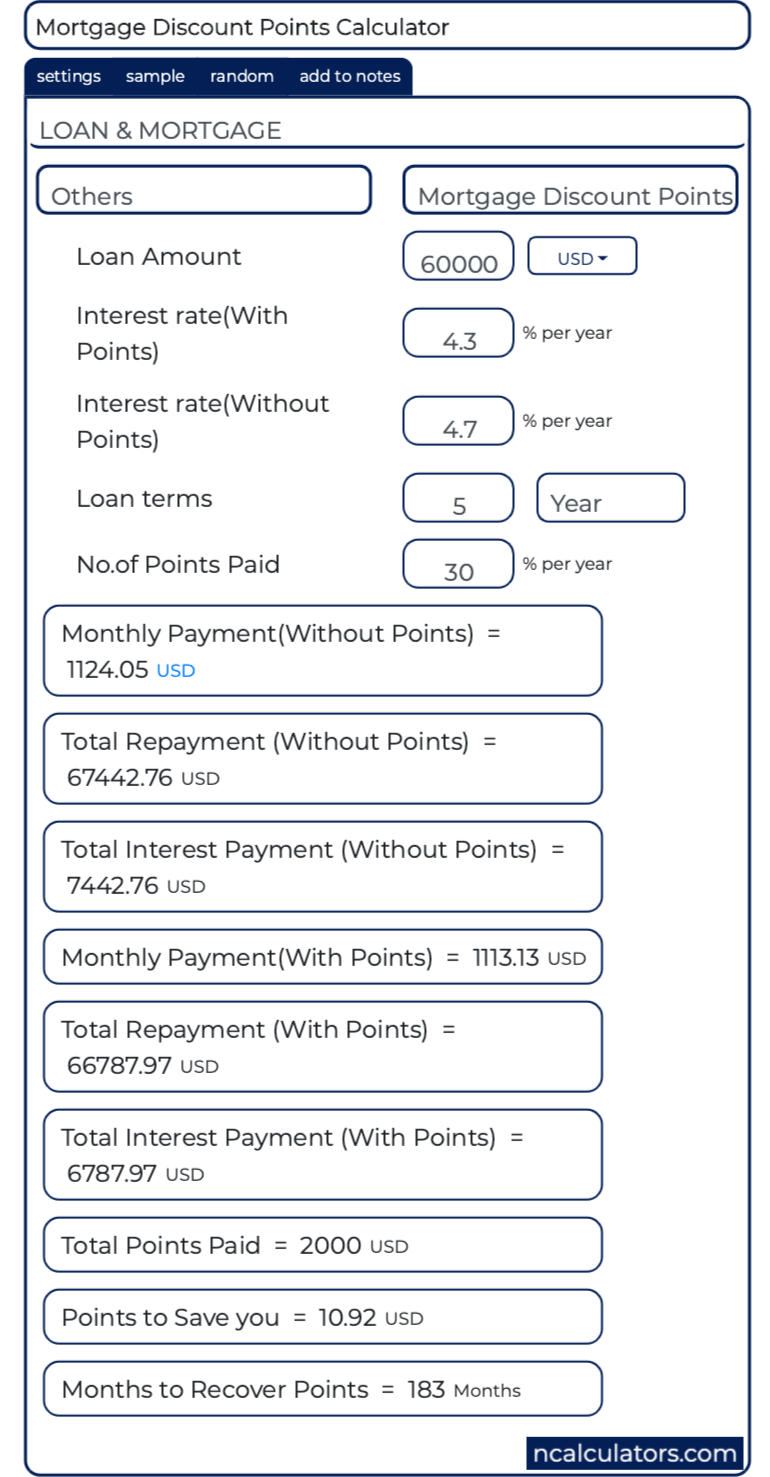

Mortgage Discount Points Calculator

Web 15 2017 you can deduct the interest you paid during the year on the first 750000 of the mortgage.

. Ad Ask a Tax Expert for Tips Right Now. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Homeowners who bought houses before December 16.

Points are fully deductible. Web February 4 2021 152 PM It depends. Learn More at AARP.

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Since you may be. Web Points are prepaid interest and may be deductible as home mortgage interest if you itemize deductions on Schedule A Form 1040 Itemized Deductions.

For 2021 Returns this. 6 Often Overlooked Tax Breaks You Dont Want to Miss. You pay them upfront to get a lower interest.

Web The mortgage insurance premium deduction phases out once your adjusted gross income AGI is more than 100000 whether youre married or single. Web If you paid points when you refinanced your mortgage you may be able to deduct them. Get Home Office Tax Info Right When You Need It.

Reduced by 10 for each 1000 your adjusted gross income AGI is more than. Points are prepaid interest. Web Points Youve Paid on Your Mortgage Points paid on a mortgage for your main home are generally deductible over the life of the loan.

Web The tax deduction for mortgage insurance premium payments was extended for 2018 and future Tax Returns on December 20 2019. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage. When prompted enter 000 for Boxes 1 2 5.

You will want to enter a separate 1098 to cover these points paid. For example if you got an 800000 mortgage to buy a. If you can deduct.

Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Taxes Can Be Complex. But if not you can deduct them pro rata over the repayment period.

Ask a Verified Accountant for Info About Personal Home Office Tax Deductions in a Chat. You can deduct the rest of the mortgage points over the life of the loan. Web Is mortgage insurance tax-deductible.

If the amount you borrow. Web However even if you meet the criteria above the mortgage insurance premium deduction will be. Points on Loans on New Loans.

Taxes Can Be Complex. Web Please try this. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Web You meet the first six points under Deducting mortgage points in the year paid above. For example if you. Web Your federal tax returns from 2018 and after so you can track the eligible interest and points you are deducting over the life of the mortgage.

Web These costs are usually deductible in the year that you purchase the home. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing.

Mortgage Interest Deduction A 2022 Guide Credible

Yske79mqso4p4m

Discount Points For A Mortgage Youtube

Should You Pay Mortgage Discount Points

Mortgage Points A Complete Guide Rocket Mortgage

Mortgage Interest Deduction A Guide Rocket Mortgage

425

How Much Savings Should I Have Accumulated By Age

Do You See The Market Homebridge Financial Services

Crypto Com Free Visa Card With Cashback

Mortgage Points A Complete Guide Rocket Mortgage

Discount Points Calculator How To Calculate Mortgage Points

Library Sme Finance Forum

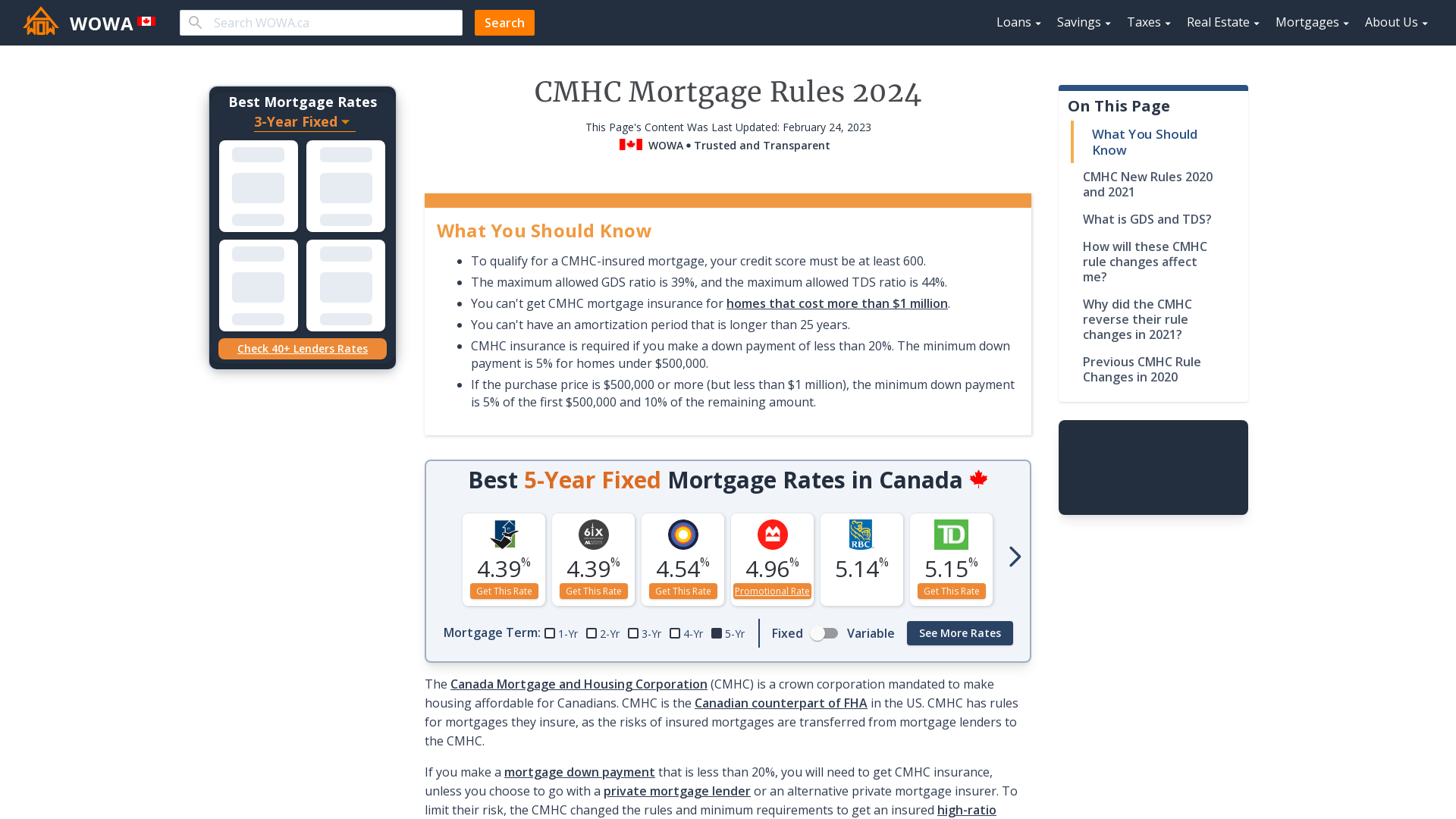

Cmhc Mortgage Rules 2023 Wowa Ca

Home Mortgage Points Deduction Taxation In The Usa Youtube

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

The Home Mortgage Interest Deduction Lendingtree